Capacity Building with Life Skills and Financial Literacy

- Sanjay Nandi

- Feb 1, 2024

- 4 min read

“Education is the manifestation of the perfection already in man” – Swami Vivekananda

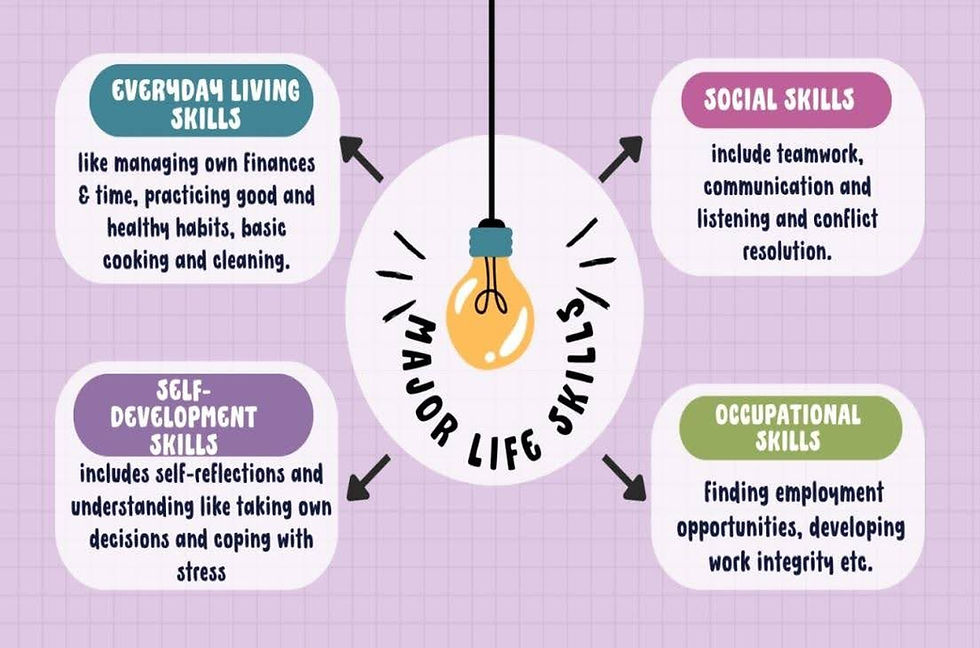

According to the United Nations Children’s Fund (UNICEF), life skills are “a behavior change or behavior development approach designed to address a balance of three areas: knowledge, attitude, and skills.” The World Health Organization (WHO) defines life skills as “the abilities for adaptive and positive behavior that enable individuals to deal effectively with the demands and challenges of everyday life.” Recognizing the crucial role life skills play in our lives, WHO emphasizes the need to instill life skills in students globally to equip them with the necessary abilities. Oxford Learners Dictionaries explain life skills as “a skill that is necessary or extremely useful to manage well in daily life. Sharing with a brother or sister can help children learn important life skills such as teamwork, problem-solving, literacy and numeracy skills. They will be taught vital life skills, like how to prepare a meal and how to use a washing machine.”

Life skills education serves as a pathway to growth and development, enabling individuals to lead their lives effectively and efficiently. These skills prepare individuals to live independently and productively within society, with the specific skills required varying based on cultural norms. Due to the dynamic nature of society, life skills are deemed crucial for everyone to cope with a rapidly changing world, leading to success both professionally and personally.

Capacity building involves enhancing capacity in a more productive, effective, and resourceful way for individuals or organizations. It can be referred to as capacity development (used by OECD) or capacity strengthening. The United Nations Development Programme (UNDP) advocates capacity development to fulfill its mission by 2030, assisting countries in eliminating poverty, achieving sustainable economic growth, and promoting human development. The Organization for Economic Co-operation and Development (OECD) defines capacity building as a process where individuals, organizations, and society unleash, strengthen, create, adapt, and maintain capacity over time to manage their affairs successfully.

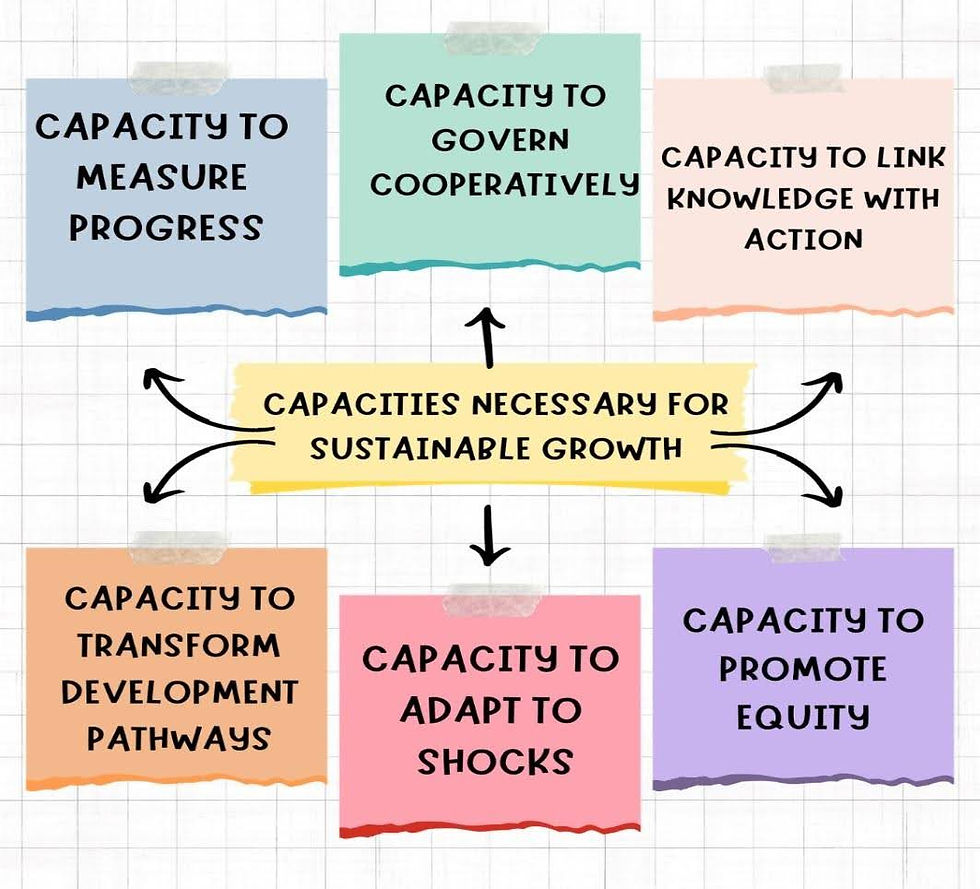

UNDP highlights the need for capacity in sustainable development, emphasizing six interdependent capacities:

(i) capacity to measure progress toward sustainable development

(ii) capacity to promote equity within and between generations

(iii) capacity to adapt to shocks and surprises

(iv) capacity to transform the system into more sustainable development pathways

(v) capacity to link knowledge with action for sustainability

(vi) capacity to devise governance arrangements that allow people to work together in exercising other capacities. Educators play a vital role in this process.

Sustainable educational practices involve developing life skills such as leadership, communication, collaboration, and management, crucial for students' personal development. Financial literacy, an individual’s ability to interpret and understand basic financial concepts, is essential for making informed decisions as lifelong learners.

Financially literate individuals contribute to economic and social prosperity by understanding macroeconomic problems, fiscal and monetary policies, and the scope and limitations of new start-ups. Educators play a crucial role in imparting financial literacy to students, fostering their ability to manage finances independently.

The United Nations Development Programme's Sustainable Development Goal 17 (Partnership for the Goals) emphasises capacity-building activities to implement sustainable alternative development goals through interregional cooperation, supporting national plans with a targeted agenda for 2030. Sharing lessons learned and best practices through workshops and related events can enhance capacity building and confidence in problem-solving.

Research Methodology:

I. Objectives of the Study:

This paper aims to achieve the following objectives based on the research questions:

To identify the pre-test scores of teacher students

To implement the capacity-building program

To identify the post-test scores of teacher students

To compare pre-test and post-test scores of teacher students

II. Hypothesis of the Study:

There is no significant difference of mean values between pre-test and post-test scores of teacher students.

III. Research Design and Data Collection:

Using an experimental research method in one of the education and research colleges under the University of Mumbai, a single group design with pre-test, planning the lessons, series of executions, and finally post-test will be conducted. Statistical analyses, including mean, median, mode, standard deviation, t-test, P-test, and inferences, will be performed.

IV. Findings:

There is a significant difference of mean values between pre-test and post-test scores of teacher students. Therefore, the null hypothesis is rejected, and the alternative hypothesis is accepted, indicating statistical significance.

V. Significance of the Study:

This study highlights the impact of financial literacy on students' daily lives as lifelong learners, providing valuable insights for parents, colleges, policymakers, and researchers.

The study focuses on capacity building with life skills and financial literacy, contributing to the financial autonomy of student teachers in B.Ed and M.Ed colleges. It paves the way for future research and practitioner studies to identify and assist students at varying levels of financial literacy and autonomy as part of the life skills.

With a growing interest in financial literacy among high school, college, and university students, this study adds to the body of knowledge, serving as a reference point for future researchers. Introducing basic financial concepts at lower secondary levels, with relevant daily examples, can lay the foundation for teacher students' understanding of money, savings, budgeting, and expenses. Advanced topics such as investing, digital banking tools, risk management, and career planning provide practical knowledge for teacher students to enhance their financial literacy.

The study's implications extend to school, college, and university administrators, principals, teachers, and policymakers, offering insights for implementing research findings to benefit society and the nation.

Capacity building on this study will help learners to make informed judgments and to take effective decisions regarding the use and management of money, as a vital part of life skills needed for a country's economic development and to help overcome macro-economic disasters, financial instability, to help them maintain overall wellbeing.

Shikha Goplani

Absolutely well-written, making financial literacy mandatory in school is a game-changer. It will not only equip students with practical skills for real-world money management but also help them setting up for a financially savvy future. Keep up the good work Sir.

Good Job One step ahead towards learning and achieving.👍 Very well done.

An excellent contribution to the understanding of the vital role financial education plays in shaping lifelong learners.

Excellent

Great job Sir, Fantastic research work on financial literacy! Your comprehensive analysis and insightful findings shed light on the critical importance of fostering financial awareness. Your work not only contributes to the academic discourse but also holds significant implications for practical applications in empowering individuals and communities. Well done on a thought-provoking and impactful study!"